Get started with our £199 Starter Kit for development and evaluation. It includes contactless terminal, test card and test account setup, plus all documentation and support needed to get you going.

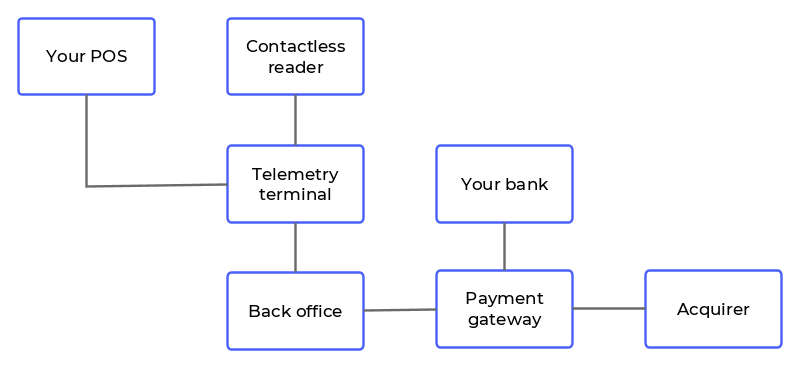

Software integration involves a simple command protocol between the payment terminal and your point-of-sale device over an Ethernet connection. The message exchange is based on MQTT messages, all detailed in our Technical Guide: please contact us to request the technical documentation. Standard MDB protocol is also available.

Hardware integration is made easier through modular, flexible design. Our two-part kit – with separate reader and telemetry – allows you to position modules more conveniently inside the POS enclosure and reduces costs if replacements are ever needed. All our contactless readers are available as flush or surface mount casings. Find out more in our hardware page.